Obamacare health insurance plans have revolutionized the way Americans access healthcare. From its inception to the intricacies of enrollment and coverage, this comprehensive guide dives deep into the world of Obamacare plans, providing valuable insights and essential information for individuals seeking quality healthcare options.

Overview of Obamacare Health Insurance Plans

The Affordable Care Act (ACA), also known as Obamacare, was signed into law in 2010 with the primary goal of increasing access to affordable health insurance for all Americans. The law aimed to reform the healthcare system and improve the quality of care while reducing overall costs.

When it comes to choosing a health insurance provider, it’s essential to consider top-rated companies that offer comprehensive coverage and excellent customer service. These companies have a reputation for reliability and affordability, making them a popular choice among consumers. By researching and comparing options, individuals can find the best fit for their healthcare needs. Learn more about top-rated health insurance companies to make an informed decision.

Brief History of the Affordable Care Act

The Affordable Care Act was a landmark piece of legislation signed by President Barack Obama in 2010. It aimed to address the growing number of uninsured Americans and the rising costs of healthcare. The ACA introduced a range of reforms to the healthcare system, including the establishment of health insurance marketplaces, expansion of Medicaid, and regulations to protect consumers.

Main Objectives of Obamacare Health Insurance Plans

- Expand access to affordable health insurance coverage for individuals and families.

- Improve the quality of healthcare services and outcomes for all Americans.

- Reduce healthcare costs and increase transparency in pricing and coverage.

- Protect consumers from insurance industry abuses and discrimination based on pre-existing conditions.

Key Features of Obamacare Health Insurance Plans

- Health Insurance Marketplaces: These online platforms allow individuals and small businesses to compare and purchase health insurance plans.

- Subsidies: Financial assistance is available to help lower-income individuals and families afford health insurance premiums.

- Essential Health Benefits: All plans sold through the marketplaces are required to cover essential health benefits, including preventive care, prescription drugs, and maternity care.

- Protections for Consumers: The ACA prohibits insurance companies from denying coverage or charging higher premiums based on pre-existing conditions.

- Medicaid Expansion: The ACA expanded Medicaid eligibility to cover more low-income individuals and families.

Types of Obamacare Health Insurance Plans

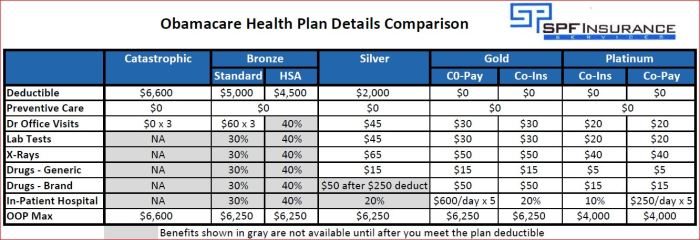

Obamacare health insurance plans offer a range of options to cater to individuals’ varying needs and budgets. These plans are categorized into different tiers based on coverage levels and costs.

Bronze Plans

Bronze plans typically have the lowest monthly premiums but the highest out-of-pocket costs. They cover around 60% of healthcare expenses, making them suitable for individuals who are generally healthy and do not anticipate frequent medical visits.

Silver Plans

Silver plans strike a balance between monthly premiums and out-of-pocket costs. They cover around 70% of healthcare expenses, making them a popular choice for those who want a moderate level of coverage without breaking the bank.

Gold Plans

Gold plans have higher monthly premiums but lower out-of-pocket costs compared to Bronze and Silver plans. They cover around 80% of healthcare expenses, making them ideal for individuals who anticipate needing more medical services throughout the year.

Platinum Plans

Platinum plans have the highest monthly premiums but the lowest out-of-pocket costs. They cover around 90% of healthcare expenses, offering comprehensive coverage for individuals who prioritize minimal out-of-pocket expenses and maximum coverage.

For families looking for affordable health insurance plans, there are various options available that cater to different needs and budgets. Affordable family health insurance plans provide coverage for all members of the family, ensuring that everyone has access to quality healthcare. By exploring different plans and comparing prices, families can find a plan that meets their needs without breaking the bank.

Discover more about affordable family health insurance plans and secure your family’s health today.

Choosing the Right Plan

When selecting an Obamacare health insurance plan, individuals should consider their healthcare needs, budget, and preferences. Those who rarely visit the doctor may opt for a Bronze plan to save on premiums, while individuals with chronic conditions or frequent medical needs may benefit from a Gold or Platinum plan for better coverage and lower out-of-pocket costs.

Health insurance is crucial for self-employed individuals, providing them with coverage for medical expenses. It offers peace of mind and financial security, ensuring that they can access healthcare without worrying about high costs. By investing in health insurance for self-employed individuals , individuals can protect themselves and their families from unexpected medical bills.

Enrollment Process for Obamacare Health Insurance

When it comes to enrolling for Obamacare health insurance plans, there are specific steps to follow to ensure you get the coverage you need. Understanding the enrollment process, open enrollment periods, special enrollment periods, and eligibility criteria is crucial for those looking to sign up for these plans.

Enrollment Steps

- Visit the official Health Insurance Marketplace website or call the Marketplace Call Center to start your enrollment process.

- Create an account on the Marketplace website or log in if you already have one.

- Fill out the application form with your personal information, including details about your household and income.

- Review the available health insurance plans and choose the one that best fits your needs and budget.

- Complete the enrollment process by selecting your plan and making the first premium payment.

Open Enrollment and Special Enrollment Periods

Open Enrollment Period: This is the time each year when you can enroll in a health insurance plan. Typically, the open enrollment period runs from November 1 to December 15. During this time, you can choose a new plan, switch plans, or renew your current plan.

It’s important to note that missing the open enrollment period may limit your options for obtaining coverage.

Special Enrollment Periods: In certain circumstances, you may qualify for a special enrollment period outside of the regular open enrollment period. Qualifying life events, such as getting married, having a baby, or losing other health coverage, may make you eligible for a special enrollment period.

Eligibility Criteria

- You must be a U.S. citizen or legal resident to enroll in an Obamacare health insurance plan.

- You cannot be currently incarcerated to qualify for these plans.

- Your income must fall within a certain range to be eligible for premium tax credits or other financial assistance through the Marketplace.

- You must not be eligible for other qualifying coverage, such as Medicaid, Medicare, or employer-sponsored insurance.

Benefits and Coverage of Obamacare Health Insurance Plans

When it comes to Obamacare health insurance plans, there are several benefits and coverage options that are designed to provide comprehensive healthcare to individuals and families. Let’s explore some of the key aspects of the benefits and coverage offered by these plans.

Essential Health Benefits Covered by Obamacare Plans

- Preventive services: Obamacare plans cover a wide range of preventive services such as vaccinations, screenings, and counseling without any out-of-pocket costs.

- Emergency services: Coverage for emergency services including ambulance transportation and emergency room visits.

- Prescription drugs: Many Obamacare plans provide coverage for prescription medications.

- Mental health and substance abuse services: Coverage for mental health treatment and substance abuse services.

- Maternity and newborn care: Comprehensive coverage for maternity care, delivery, and care for newborns.

Additional Benefits or Coverage Options Available

- Dental and vision care: Some Obamacare plans offer optional coverage for dental and vision care.

- Alternative therapies: Coverage for alternative therapies such as acupuncture or chiropractic care may be available in certain plans.

- Telemedicine services: Some plans may include coverage for virtual doctor visits through telemedicine services.

- Health and wellness programs: Certain plans may offer incentives or coverage for participation in health and wellness programs.

Comparison with Traditional Health Insurance Plans

- Preventive care: Obamacare plans typically offer more robust coverage for preventive care services compared to traditional health insurance plans.

- Maternity care: The coverage for maternity care and newborn care is usually more comprehensive in Obamacare plans.

- Mental health services: Obamacare plans often provide better coverage for mental health and substance abuse services than traditional plans.

- Prescription drugs: Many Obamacare plans offer more affordable options for prescription drug coverage compared to traditional plans.

Cost and Subsidies of Obamacare Health Insurance Plans

When it comes to Obamacare health insurance plans, understanding the cost and subsidies is crucial for making informed decisions about your coverage. Subsidies play a significant role in making healthcare more affordable for individuals and families who qualify based on their income. These subsidies are designed to help lower the cost of monthly premiums and out-of-pocket expenses for those who need financial assistance.

How Subsidies Work

Subsidies are available through the Health Insurance Marketplace, where individuals can apply for financial assistance based on their income and family size. The amount of subsidy you receive is determined by factors such as your household income, the size of your family, and where you live. These subsidies can help reduce the monthly premium costs of your health insurance plan, making it more affordable for you to maintain coverage.

Factors Influencing Cost

Several factors can influence the cost of premiums and out-of-pocket expenses for Obamacare health insurance plans. These factors include your age, location, tobacco use, and the level of coverage you choose. Younger individuals typically pay lower premiums compared to older adults, while smokers may face higher premium costs. Additionally, the type of plan you select, such as a Bronze, Silver, Gold, or Platinum plan, will impact both your premiums and out-of-pocket expenses.

Tips for Cost Savings, Obamacare health insurance plans

– Compare different plans: Take the time to compare the costs and coverage options of different Obamacare health insurance plans to find the best fit for your budget and healthcare needs.

– Consider subsidies: If you qualify for subsidies, make sure to take advantage of this financial assistance to reduce your monthly premium costs.

– Choose a higher deductible: Opting for a plan with a higher deductible can lower your monthly premiums, but be prepared for higher out-of-pocket costs if you need medical care.

– Utilize preventive services: Many Obamacare plans offer free preventive services, such as screenings and vaccinations, which can help you stay healthy and avoid costly medical expenses in the long run.

In conclusion, Obamacare health insurance plans offer a wide array of benefits and coverage options designed to cater to the diverse needs of individuals. By understanding the nuances of these plans and exploring the available subsidies, individuals can make informed decisions to secure the best healthcare coverage for themselves and their families.