Medicare Part D prescription drug coverage takes center stage in this detailed guide, offering valuable insights into the coverage, costs, enrollment process, formularies, coverage gaps, and extra help available under this essential Medicare program.

Whether you’re new to Medicare or considering enrolling in Part D, this article will provide you with the necessary information to make informed decisions about your prescription drug coverage.

Overview of Medicare Part D Prescription Drug Coverage

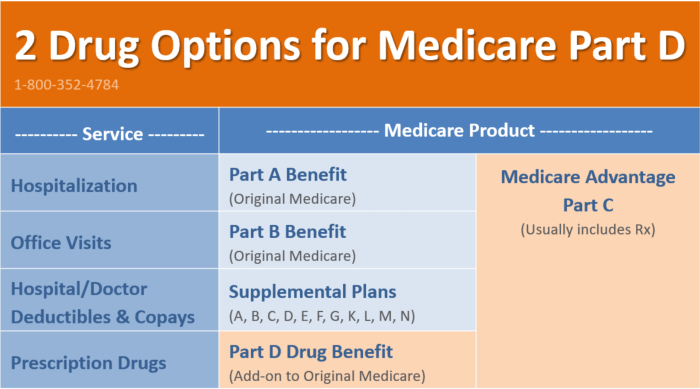

Medicare Part D is a prescription drug coverage program offered by Medicare to help beneficiaries pay for their prescription medications. It is different from other parts of Medicare, such as Part A and Part B, which mainly cover hospital and medical services.

Purpose of Medicare Part D

Medicare Part D aims to provide access to affordable prescription drugs for Medicare beneficiaries. This coverage helps individuals afford necessary medications to manage their health conditions and improve their quality of life.

Eligibility for Medicare Part D

Individuals who are eligible for Medicare Part A and/or enrolled in Medicare Part B are typically eligible to enroll in Medicare Part D. This includes people aged 65 and older, as well as certain younger individuals with disabilities.

Importance of Prescription Drug Coverage

Having prescription drug coverage under Medicare Part D is crucial for beneficiaries to access necessary medications without facing high out-of-pocket costs. It ensures that individuals can afford their prescriptions and manage their health conditions effectively.

Coverage and Costs

Medicare Part D prescription drug coverage includes a wide range of medications to help beneficiaries manage their health conditions. These drugs are typically categorized into different tiers based on their cost and coverage level.

Types of Drugs Covered

- Generic Drugs: These are low-cost medications that have the same active ingredients as brand-name drugs.

- Brand-Name Drugs: These are medications developed and marketed by pharmaceutical companies with patent protection.

- Specialty Drugs: These are high-cost medications used to treat complex or chronic conditions like cancer or rheumatoid arthritis.

- Preferred Drugs: Some plans may have a list of preferred medications that offer lower copayments for beneficiaries.

Costs Associated with Medicare Part D

Medicare Part D coverage involves several costs that beneficiaries need to consider:

- Premiums: Beneficiaries pay a monthly premium to enroll in a Medicare Part D plan.

- Deductibles: A deductible is the amount beneficiaries must pay out-of-pocket before the plan starts covering the costs of medications.

- Copayments: These are fixed amounts that beneficiaries pay for each prescription, often varying based on the tier of the drug.

Comparison of Coverage Options

- Stand-Alone Prescription Drug Plans (PDPs): These plans offer drug coverage as a standalone option and can vary in terms of premiums, deductibles, and drug formularies.

- Medicare Advantage Prescription Drug Plans (MA-PDs): These plans combine medical and drug coverage in one package, offering convenience but potentially limiting choices of healthcare providers.

Enrollment Process: Medicare Part D Prescription Drug Coverage

When it comes to enrolling in Medicare Part D prescription drug coverage, there are specific steps to follow to ensure you get the coverage you need. Understanding the enrollment process, different periods, and potential penalties for late enrollment is crucial for making informed decisions about your healthcare coverage.

Step-by-Step Guide for Enrollment

- 1. Determine Eligibility: To enroll in Medicare Part D, you must first be eligible for Medicare Part A or Part B.

- 2. Compare Plans: Research and compare different Medicare Part D plans available in your area to find one that best suits your prescription drug needs.

- 3. Enroll: Once you have chosen a plan, you can enroll online, by phone, or by contacting the plan directly.

- 4. Pay Premiums: Make sure to pay your monthly premiums to maintain coverage.

Enrollment Periods and Coverage Impact

- Initial Enrollment Period: This is the 7-month period that begins 3 months before you turn 65, includes your birthday month, and extends 3 months after.

- Annual Enrollment Period: Occurs from October 15th to December 7th each year, allowing you to make changes to your Medicare coverage.

- Special Enrollment Period: You may qualify for this period if you experience certain life events, such as moving to a new area or losing other prescription drug coverage.

Penalties for Late Enrollment

- Delay in Coverage: If you don’t enroll in Medicare Part D when first eligible and don’t have other creditable prescription drug coverage, you may face a late enrollment penalty.

- Calculation: The penalty is calculated by multiplying 1% of the “national base beneficiary premium” by the number of full, uncovered months you were eligible but didn’t enroll.

- Long-Term Impact: The late enrollment penalty is added to your monthly premium for as long as you have Medicare Part D coverage, potentially increasing your overall costs.

Formularies and Drug Coverage

Formularies play a crucial role in determining which prescription drugs are covered under Medicare Part D plans. These are lists of medications that are approved for coverage by the insurance provider.

Comparison of Formularies, Medicare Part D prescription drug coverage

Different Medicare Part D plans have their own formularies, which can vary widely in terms of the drugs covered and the associated costs. Beneficiaries must carefully review each plan’s formulary to ensure their prescribed medications are included.

- Some plans may offer more comprehensive coverage for certain drug classes, while others may have restrictions on specific medications.

- Formularies can also impact the out-of-pocket costs for beneficiaries, as drugs listed in lower tiers are usually more affordable than those in higher tiers.

- Beneficiaries should compare formularies from different plans to find one that best meets their prescription drug needs at the lowest cost.

Coverage Gaps and Extra Help

Understanding the Medicare Part D coverage gap (donut hole) and how to access Extra Help can significantly impact beneficiaries’ prescription drug costs.

Medicare Part D Coverage Gap (Donut Hole)

The coverage gap, also known as the donut hole, is a phase within Medicare Part D where beneficiaries have to pay a higher percentage of their prescription drug costs. Once the total drug costs reach a certain limit, beneficiaries enter the coverage gap until they reach catastrophic coverage.

Extra Help Program

The Extra Help program, also called the Low-Income Subsidy (LIS), provides financial assistance to low-income beneficiaries to help cover prescription drug costs. Eligibility is based on income and resources, and those who qualify receive assistance in paying premiums, deductibles, and copayments.

Minimizing Costs and Accessing Extra Help

- Review the formulary: Check if there are generic alternatives to lower costs.

- Use preferred pharmacies: Some plans offer lower copayments at specific pharmacies.

- Apply for Extra Help: Complete an application through Social Security to determine eligibility for financial assistance.

- Utilize patient assistance programs: Some drug manufacturers offer programs to help reduce the cost of medications.

In conclusion, Medicare Part D prescription drug coverage serves as a vital resource for beneficiaries, ensuring access to necessary medications while navigating the complexities of coverage options and costs. Stay informed, stay covered, and prioritize your health with Medicare Part D.

When it comes to private health insurance for individuals, it’s important to find a plan that suits your specific needs. Whether you’re looking for coverage for physical therapy and rehabilitation or simply want health insurance plans with low premiums, there are options out there for everyone. With the right plan, you can ensure that you have access to the care you need without breaking the bank.

Learn more about private health insurance for individuals and explore your options today.

When it comes to private health insurance for individuals, it’s important to find a plan that suits your specific needs and budget. Private health insurance for individuals offers personalized coverage options that cater to your unique health requirements.

For those seeking coverage for physical therapy and rehabilitation, it’s essential to choose a plan that includes these services. Coverage for physical therapy and rehabilitation can make a significant difference in your recovery process, providing the support you need to regain your strength and mobility.

Exploring health insurance plans with low premiums can help you find affordable coverage without compromising on quality. With health insurance plans with low premiums , you can access essential healthcare services while staying within your budget constraints.