Health insurance for chronic disease management takes center stage in this comprehensive guide, offering valuable insights to navigate the complex world of healthcare coverage with ease.

Explore the key aspects of different insurance plans, considerations for selecting the right one, and strategies to make the most of your benefits for effective chronic disease management.

Importance of Health Insurance for Chronic Disease Management

Health insurance plays a crucial role in effectively managing chronic diseases by providing access to necessary treatments and medications.

When it comes to preparing for a new addition to the family, having health insurance coverage for maternity is essential. This type of insurance can help cover the costs of prenatal care, labor and delivery, and postpartum care, ensuring that both mother and baby receive the best possible medical attention without breaking the bank.

Benefits of Health Insurance for Chronic Disease Management

- Health insurance coverage ensures individuals with chronic conditions can afford essential medical care without facing significant financial burdens.

- It allows patients to regularly visit healthcare providers for check-ups and monitoring of their condition, leading to better disease management and prevention of complications.

- Health insurance often covers the costs of prescription medications, therapies, and medical procedures required to treat chronic diseases, making them more accessible to patients.

- By having health insurance, individuals with chronic conditions can receive timely and appropriate care, improving their quality of life and overall health outcomes.

Examples of Health Insurance Impact on Chronic Disease Management

- A patient diagnosed with diabetes who has health insurance can afford insulin, glucose monitoring supplies, and regular doctor visits to effectively manage their condition and prevent complications.

- Individuals with asthma can access inhalers, medications, and emergency care services through health insurance, ensuring they can manage their symptoms and prevent severe attacks.

- Health insurance coverage for mental health services allows individuals with conditions like depression or anxiety to receive therapy and counseling, improving their mental well-being and overall quality of life.

Types of Health Insurance Plans for Chronic Disease Management

When it comes to managing chronic diseases, having the right health insurance plan is essential. Different types of health insurance plans offer varying levels of coverage and access to care. Let’s compare and contrast some common types of health insurance plans suitable for managing chronic diseases.

Health Maintenance Organizations (HMOs)

- HMOs typically require members to choose a primary care physician (PCP) who coordinates all of their healthcare needs.

- Members usually need a referral from their PCP to see a specialist.

- Coverage under HMOs is often more restrictive in terms of network providers but may offer lower out-of-pocket costs.

- Access to specialists, medications, and treatment options may be limited compared to other types of plans.

Preferred Provider Organizations (PPOs)

- PPOs offer more flexibility in choosing healthcare providers without needing referrals.

- Members can see specialists without a referral, although staying in-network typically results in lower costs.

- While PPOs may have higher premiums than HMOs, they generally provide broader coverage and more options for care.

- Access to specialists, medications, and treatment options is typically better with PPOs compared to HMOs.

High-Deductible Health Plans (HDHPs), Health insurance for chronic disease management

- HDHPs have lower premiums but higher deductibles that must be met before insurance coverage kicks in.

- These plans are often paired with Health Savings Accounts (HSAs) to help cover out-of-pocket costs.

- While HDHPs can be cost-effective for individuals with chronic conditions who do not require frequent care, they may result in higher out-of-pocket costs for ongoing treatment.

- Access to specialists, medications, and treatment options may vary depending on the specific plan and deductible amount.

Considerations When Choosing Health Insurance for Chronic Disease Management

When selecting a health insurance plan for chronic disease management, there are several factors to consider to ensure you have the coverage you need.

Importance of Coverage for Prescription Drugs

Ensuring that your health insurance plan covers prescription drugs is crucial for managing chronic conditions. Without adequate coverage, the cost of medications can quickly add up and become a financial burden.

- Check if the plan includes your specific medications on its formulary.

- Look into any restrictions or prior authorization requirements for prescription drugs.

- Consider the copay or coinsurance amount for medications to understand your out-of-pocket costs.

Importance of Coverage for Pre-existing Conditions

Having coverage for pre-existing conditions is essential when managing chronic diseases. Make sure your health insurance plan does not exclude coverage for conditions you already have.

- Verify that your chronic condition is not considered a pre-existing condition under the plan.

- Understand any waiting periods or limitations related to pre-existing conditions.

- Consider whether the plan offers comprehensive coverage for ongoing treatment of pre-existing conditions.

Importance of Coverage for Specialist Visits

Access to specialists is crucial for managing chronic diseases effectively. Ensure that your health insurance plan provides coverage for specialist visits to receive the care you need.

- Check if the plan requires referrals to see specialists or allows direct access.

- Verify the network of specialists included in the plan to ensure you have options for care.

- Consider the cost-sharing requirements for specialist visits, such as copays or coinsurance.

Role of Network Coverage and Out-of-pocket Costs

The network coverage and out-of-pocket costs of a health insurance plan can significantly impact your access to care and financial burden. Understanding these aspects is crucial in choosing the right plan for chronic disease management.

- Evaluate the network of healthcare providers included in the plan to ensure you can access care conveniently.

- Consider whether your current healthcare providers are in-network to avoid additional costs.

- Compare the out-of-pocket costs, including deductibles, copays, and coinsurance, to determine the overall cost of the plan.

Strategies for Maximizing Health Insurance Benefits for Chronic Disease Management

When it comes to managing chronic diseases, utilizing health insurance benefits effectively can make a significant difference in the quality of care and outcomes. Regular check-ups, preventive care, and disease management programs play a crucial role in managing chronic conditions. Navigating the complexities of health insurance policies is essential to access the necessary care for ongoing treatment and support.

Importance of Regular Check-ups and Preventive Care

Regular check-ups are essential for monitoring the progression of chronic diseases, adjusting treatment plans, and addressing any emerging health concerns. Preventive care, such as screenings and vaccinations, can help prevent complications and improve overall health outcomes for individuals with chronic conditions.

- Regular check-ups allow healthcare providers to assess the effectiveness of current treatments and make necessary adjustments to manage chronic diseases effectively.

- Preventive care measures can help identify potential health risks early on, allowing for timely interventions and proactive management of chronic conditions.

- By staying up to date with recommended screenings and vaccinations, individuals can reduce the risk of complications associated with chronic diseases and maintain better overall health.

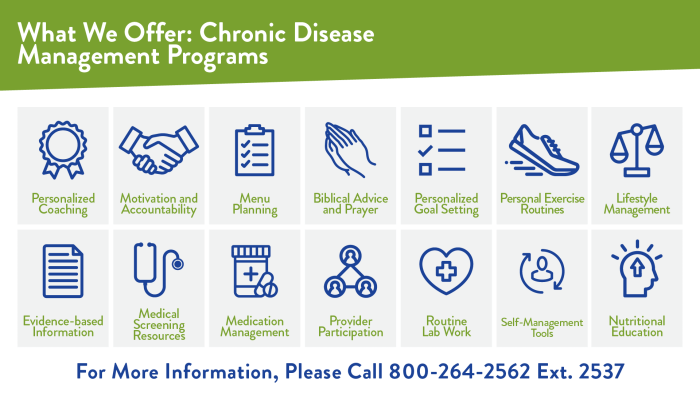

Navigating Health Insurance Policies for Disease Management Programs

Understanding the coverage and benefits provided by health insurance policies is crucial for accessing disease management programs and specialized care for chronic conditions. Navigating the complexities of insurance plans can help individuals maximize their benefits and receive the necessary support for managing their health.

- Reviewing the details of health insurance policies can help individuals identify specific coverage for chronic disease management, such as medications, treatments, and specialist consultations.

- Seeking guidance from healthcare providers and insurance representatives can provide clarity on coverage options, prior authorizations, and referral requirements for accessing disease management programs.

- Keeping track of out-of-pocket costs, deductibles, and copayments can help individuals budget for ongoing healthcare expenses related to chronic disease management.

In conclusion, understanding the importance of health insurance in managing chronic conditions is essential for ensuring access to necessary treatments and reducing financial burdens. By making informed decisions and leveraging your coverage effectively, you can prioritize your health and well-being with confidence.

For individuals living with chronic conditions, having access to health insurance for chronic conditions is crucial. This type of insurance can help cover the costs of ongoing treatments, medications, and specialist visits, ensuring that patients can manage their conditions effectively and affordably.

Business owners looking to provide comprehensive healthcare options for their employees should consider group health insurance plans for businesses. These plans can help attract and retain top talent, while also promoting a healthy and productive work environment for all staff members.