Cost of prescription drug coverage sets the stage for understanding the financial aspects of obtaining necessary medications. The complexities of pricing, coverage, and out-of-pocket expenses will be explored in detail.

As we delve deeper into the world of prescription drug coverage, we uncover the various elements that contribute to the overall costs and ways to navigate through them efficiently.

Overview of Prescription Drug Coverage

Prescription drug coverage refers to the insurance plan or policy that helps individuals pay for their prescription medications. This coverage can be provided through private insurance companies, Medicare, or Medicaid, and it helps reduce the out-of-pocket costs associated with purchasing necessary medications.

Having prescription drug coverage is important as it ensures that individuals have access to affordable medications to manage their health conditions. Without this coverage, the cost of prescription drugs can be prohibitively expensive, leading some individuals to forgo necessary medications due to financial constraints.

Prescription drug coverage works by requiring individuals to pay a copayment or coinsurance for their medications, while the insurance plan covers the remaining cost. The specific details of coverage, such as formulary lists, tiered pricing, and coverage limits, vary depending on the insurance plan. Overall, prescription drug coverage helps make medications more accessible and affordable for those who need them.

Types of Prescription Drug Plans

When it comes to prescription drug coverage, there are several types of plans available to consumers. Each type of plan has its own characteristics and coverage options, so it’s important to understand the differences in order to choose the plan that best meets your needs.

Stand-Alone Prescription Drug Plans (PDPs)

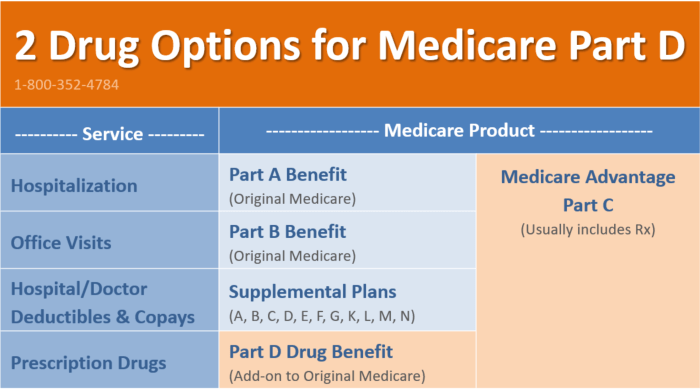

Stand-alone Prescription Drug Plans (PDPs) are designed to work alongside Original Medicare (Parts A and B). These plans offer coverage specifically for prescription drugs and are purchased separately from other Medicare coverage. PDPs typically have a formulary, which is a list of covered drugs, and may have different tiers with varying cost-sharing amounts.

Medicare Advantage Prescription Drug Plans (MA-PDs)

Medicare Advantage Prescription Drug Plans (MA-PDs) are offered by private insurance companies approved by Medicare. These plans provide all-in-one coverage that includes hospital, medical, and prescription drug coverage. MA-PDs often have networks of providers and may require referrals to see specialists.

Employer-Sponsored Prescription Drug Plans

Employer-sponsored Prescription Drug Plans are offered by some employers as part of their employee benefits package. These plans may have different cost-sharing structures and formularies compared to other types of plans. It’s important to review the details of your employer-sponsored plan to understand the coverage it provides.

State Pharmaceutical Assistance Programs (SPAPs)

State Pharmaceutical Assistance Programs (SPAPs) are state-run programs that help low-income individuals pay for their prescription medications. These programs vary by state and may have different eligibility requirements and coverage options. SPAPs can provide assistance with premiums, deductibles, and copayments for prescription drugs.

Comparing and Contrasting Coverage, Cost of prescription drug coverage

When comparing different types of prescription drug plans, it’s important to consider factors such as monthly premiums, formularies, cost-sharing amounts, network restrictions, and coverage for specific medications. Each type of plan has its own advantages and limitations, so carefully evaluate your options based on your individual healthcare needs.

Factors Affecting the Cost of Prescription Drug Coverage

When it comes to the cost of prescription drug coverage, there are several factors that can influence how much you pay for your medications. Understanding these factors is crucial in managing your healthcare expenses effectively.

Deductibles, copayments, and coinsurance all play a significant role in determining the cost of prescription drug coverage. Deductibles are the amount you must pay out of pocket before your insurance kicks in. Copayments are fixed amounts you pay for each prescription, while coinsurance is a percentage of the cost of the medication that you are responsible for.

Impact of Deductibles, Copayments, and Coinsurance

- Deductibles: Higher deductibles typically mean lower monthly premiums but higher out-of-pocket costs when you need to fill a prescription.

- Copayments: Different tiers of copayments are often assigned to different types of medications, with generic drugs being cheaper than brand-name drugs.

- Coinsurance: This can vary based on the drug and may result in you paying a percentage of the medication’s cost, which can add up for expensive prescriptions.

Role of Formularies and Drug Tiers

- Formularies: These are lists of medications covered by your insurance plan. Using drugs on the formulary can result in lower costs, while non-formulary drugs may be more expensive or not covered at all.

- Drug Tiers: Insurers often categorize medications into different tiers based on their cost and effectiveness. The higher the tier, the more you may have to pay out of pocket.

Strategies to Reduce Prescription Drug Costs

When it comes to managing the cost of prescription medications, there are several strategies that can help individuals save money and access the medications they need. From utilizing generic drugs to exploring alternative ways to obtain prescriptions at a lower cost, there are various options to consider.

Use of Generic Drugs

One effective way to reduce prescription drug costs is by opting for generic versions of medications whenever possible. Generic drugs contain the same active ingredients as their brand-name counterparts but are typically available at a lower price. By choosing generics over brand-name medications, individuals can achieve significant cost savings without compromising on the quality or effectiveness of their treatment.

Exploring Alternative Ways to Obtain Prescriptions

In addition to considering generic drugs, individuals can explore alternative ways to obtain prescriptions at a lower cost. This may include utilizing mail-order pharmacies, seeking out patient assistance programs offered by pharmaceutical companies, or discussing more affordable medication options with healthcare providers. By being proactive and exploring different avenues for obtaining prescriptions, individuals can potentially lower their out-of-pocket expenses and better manage the cost of their medications.

Coverage Gaps and Out-of-Pocket Costs

When it comes to prescription drug coverage, there can be instances where individuals may face coverage gaps and high out-of-pocket costs. Understanding these aspects is crucial for managing healthcare expenses effectively.

Coverage Gaps in Prescription Drug Plans

In prescription drug plans, coverage gaps refer to periods when the plan provides limited or no coverage for certain medications. One common coverage gap is the “donut hole,” which occurs in Medicare Part D plans when the individual reaches a certain spending threshold. During this phase, the individual may have to pay a higher percentage of the drug costs until catastrophic coverage kicks in.

Out-of-Pocket Costs Variation

Out-of-pocket costs in prescription drug plans can vary significantly depending on the plan’s structure. Co-payments, coinsurance, deductibles, and annual out-of-pocket maximums all contribute to the total out-of-pocket expenses. Some plans may have lower monthly premiums but higher out-of-pocket costs, while others may have higher premiums with lower out-of-pocket expenses.

Situations with High Out-of-Pocket Costs

There are situations where individuals may face high out-of-pocket costs despite having prescription drug coverage. For example, if a medication is not on the plan’s formulary or requires prior authorization, the individual may have to pay the full cost out-of-pocket. Additionally, specialty medications or brand-name drugs with no generic alternatives can also lead to high out-of-pocket expenses.

In conclusion, the cost of prescription drug coverage remains a critical aspect of healthcare that requires careful consideration and planning. By being informed and proactive, individuals can better manage their expenses and access the medications they need.

When it comes to coverage for physical therapy and rehabilitation, it’s important to have a comprehensive health insurance plan that includes these services. Without proper coverage, the cost of therapy sessions can quickly add up, putting a strain on your finances. To learn more about coverage options for physical therapy and rehabilitation, check out this informative article on Coverage for physical therapy and rehabilitation.

For low-income families, finding affordable health insurance options can be a challenge. However, there are programs and resources available to help make quality healthcare more accessible. To explore some of the affordable health insurance options for low-income families, be sure to visit this helpful guide at Affordable health insurance options for low-income families.

Managing chronic diseases can be a lifelong journey that requires ongoing medical care and support. Having health insurance that covers chronic disease management is essential for ensuring you receive the necessary treatments and medications. To find out more about health insurance options for chronic disease management, take a look at this insightful article on Health insurance for chronic disease management.