Health insurance with mental health coverage brings a crucial aspect of well-being into focus, offering support and resources for individuals facing mental health challenges. As we delve into the intricacies of this coverage, we uncover a world where mental health is prioritized and valued within the realm of healthcare.

Exploring the various facets of mental health coverage within health insurance plans sheds light on the significance of this inclusion and its impact on individuals’ lives.

Importance of Mental Health Coverage in Health Insurance: Health Insurance With Mental Health Coverage

In today’s fast-paced and stressful world, mental health is just as important as physical health. Mental health coverage in health insurance plans plays a crucial role in ensuring overall well-being and quality of life for individuals.

Impact on Overall Well-being

Mental health coverage helps individuals access necessary treatments and therapies for conditions such as anxiety, depression, bipolar disorder, and more. By addressing these mental health issues, individuals can experience improved emotional stability, better relationships, and increased productivity in their daily lives.

Benefits of Mental Health Coverage

– Early intervention: Mental health coverage allows individuals to seek help at the early stages of mental health conditions, preventing them from becoming severe.

– Reduced stigma: With mental health coverage, individuals are more likely to seek help without the fear of judgment, leading to improved mental health outcomes.

– Comprehensive care: Health insurance plans with mental health coverage often provide a range of mental health services, including therapy, medication, and counseling, ensuring holistic care for individuals.

Comparison of Quality of Life

Individuals with mental health coverage generally experience a higher quality of life compared to those without coverage. They have better access to mental health professionals, support systems, and resources, leading to improved mental well-being and overall health outcomes.

Types of Mental Health Services Covered by Health Insurance

When it comes to mental health services covered by health insurance, there are various types of treatments and therapies that are typically included in the coverage. Understanding these services and how to access them is crucial for individuals seeking mental health support through their insurance plans.

Counseling and Therapy

- Individual therapy sessions with licensed therapists or psychologists.

- Group therapy sessions for specific mental health conditions.

- Family therapy to address interpersonal issues within the family unit.

Psychiatric Services

- Psychiatric evaluations and assessments to diagnose mental health conditions.

- Medication management for individuals requiring psychiatric medications.

- Follow-up appointments with psychiatrists for ongoing care and monitoring.

Inpatient and Outpatient Services

- Coverage for inpatient mental health treatment in a hospital or residential facility.

- Outpatient services such as day programs, intensive outpatient programs (IOP), and partial hospitalization programs (PHP).

Telehealth and Online Therapy

- Virtual therapy sessions through telehealth platforms for remote access to mental health care.

- Online therapy services for counseling and support via chat, video, or phone.

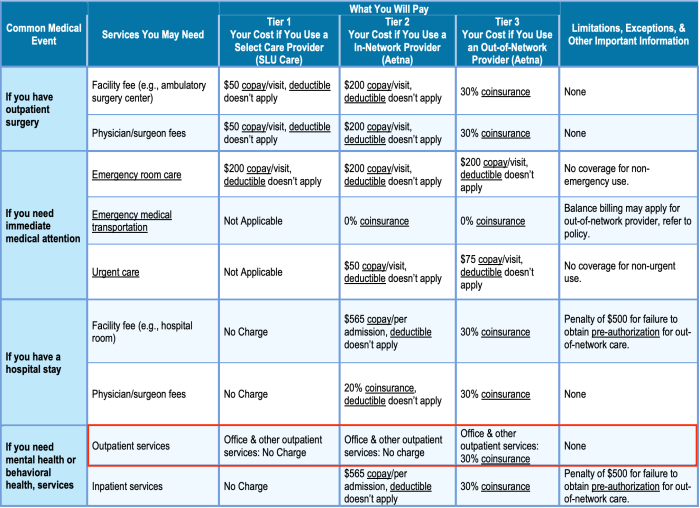

Limitations and Restrictions

- Some insurance plans may have limitations on the number of therapy sessions covered per year.

- Certain treatments or therapies may require pre-authorization from the insurance company.

- Coverage for out-of-network providers may be limited, leading to higher out-of-pocket costs for the individual.

Differences from General Medical Coverage

- Mental health services often have separate deductibles and copayments from general medical services.

- Insurance plans may have specific networks of mental health providers that differ from medical provider networks.

- Coverage for mental health services may be subject to different criteria for medical necessity and treatment authorization.

Cost Considerations and Affordability of Health Insurance with Mental Health Coverage

When it comes to health insurance plans that include mental health coverage, cost considerations play a significant role in determining affordability for individuals. Understanding the financial implications of such coverage is crucial for individuals seeking comprehensive healthcare options.

Cost Implications of Including Mental Health Coverage

Including mental health coverage in health insurance plans can lead to higher premiums due to the additional services covered. Insurance companies factor in the costs associated with mental health treatments, therapy sessions, and medications when determining the overall premium amount. However, the benefits of having mental health coverage can outweigh the higher costs in the long run by providing access to crucial services for mental well-being.

Strategies for Making Mental Health Coverage More Affordable

– Look for health insurance plans with subsidies or cost-sharing options specifically for mental health services.

– Consider high-deductible plans with lower premiums that still offer comprehensive mental health coverage.

– Utilize employer-sponsored health insurance options that may include mental health benefits at a reduced cost.

– Explore government-funded programs or community resources that offer mental health support at a lower cost.

Standalone Mental Health Insurance vs. Coverage within General Health Insurance Plan

Standalone mental health insurance plans are designed specifically to cover mental health services and may offer more tailored coverage compared to general health insurance plans. However, standalone plans can be more expensive and may not provide the comprehensive healthcare coverage needed for other medical conditions. On the other hand, coverage within a general health insurance plan may offer a more cost-effective solution for individuals seeking overall healthcare coverage with mental health benefits included.

Financial Benefits of Investing in Health Insurance with Mental Health Coverage

Investing in health insurance plans with mental health coverage can lead to long-term financial benefits by reducing out-of-pocket expenses for mental health services. By having coverage for therapy, counseling, and psychiatric care, individuals can access necessary treatments without facing substantial financial burdens. Additionally, early intervention through mental health coverage can prevent more severe conditions that may require costly treatments in the future.

Impact of Mental Health Parity Laws on Health Insurance Coverage

Mental health parity laws are legislation that require health insurance plans to provide equal coverage for mental health services as they do for physical health services. These laws aim to eliminate disparities in coverage and ensure that individuals have access to the mental health care they need.

Improved Access to Mental Health Services

- One example of how mental health parity laws have improved access to mental health services is by removing limitations on the number of therapy sessions covered by insurance plans. Prior to these laws, individuals may have been restricted to a certain number of sessions, hindering their ability to receive adequate treatment.

- Another way mental health parity laws have enhanced access is by prohibiting higher copayments or deductibles for mental health services compared to physical health services. This helps make mental health care more affordable and accessible for individuals seeking treatment.

Challenges in Mental Health Coverage Despite Parity Laws, Health insurance with mental health coverage

- Despite the implementation of mental health parity laws, there are still challenges in mental health coverage, such as limited provider networks for mental health services. This can result in long wait times for appointments or difficulty finding a provider that accepts insurance.

- Another challenge is the lack of transparency in coverage details for mental health services. Some insurance plans may have complex policies or restrictions that make it challenging for individuals to understand what is covered and what is not.

Effectiveness of Mental Health Parity Laws

- Mental health parity laws have been effective in ensuring comprehensive coverage by requiring insurance plans to treat mental health services on par with physical health services. This has helped reduce stigma around mental health and improve access to care for individuals in need.

- Studies have shown that mental health parity laws have led to increased utilization of mental health services among those with insurance coverage, indicating that these laws have been successful in encouraging individuals to seek treatment when needed.

In conclusion, the integration of mental health coverage in health insurance plans not only enhances access to crucial services but also contributes to a holistic approach to healthcare that prioritizes mental well-being. By understanding the importance of such coverage, individuals can make informed decisions that promote their overall health and quality of life.

When it comes to choosing the best health insurance provider, it’s important to consider the top-rated health insurance companies. These companies have a proven track record of providing excellent coverage and customer service. You can find a list of the top-rated health insurance companies here.

For families looking for affordable health insurance plans, it’s essential to explore all available options. Affordable family health insurance plans offer comprehensive coverage at a reasonable cost. You can learn more about affordable family health insurance plans here.

Enrolling in a marketplace health insurance plan can provide individuals and families with access to quality coverage at competitive rates. Marketplace health insurance enrollment is a straightforward process that can be completed online. Find out more about marketplace health insurance enrollment here.