How to save on health insurance premiums takes center stage as we delve into the realm of navigating the complex world of healthcare costs. From researching plans to understanding premiums, this guide offers insights to help you make informed decisions and save money along the way.

Exploring the intricacies of health insurance premiums and cost-saving measures, this guide aims to empower you with the knowledge needed to secure affordable coverage without compromising on quality care.

Researching Health Insurance Plans

Researching different health insurance plans is crucial to finding the most suitable and affordable option for your needs. Here are some tips on how to effectively compare coverage and premiums and find the best plan for you:

Comparing Coverage and Premiums

When researching health insurance plans, be sure to compare the coverage offered by each plan. Look at the services and treatments covered, as well as any exclusions or limitations. Consider your own healthcare needs and make sure the plan provides adequate coverage for those specific needs.

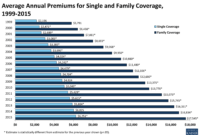

In addition to coverage, compare the premiums of different plans. Premiums can vary significantly between plans, so it’s important to find a balance between cost and coverage. Keep in mind that a plan with a lower premium may have higher out-of-pocket costs, so consider your budget and healthcare needs when comparing premiums.

Finding Affordable Options

To find affordable health insurance options, consider looking into government-sponsored programs like Medicaid or the Children’s Health Insurance Program (CHIP) if you qualify. These programs provide low-cost or free health coverage to eligible individuals and families.

You can also explore health insurance marketplaces or work with a licensed insurance broker to compare plans and find the best rates. Look for plans with high deductibles and lower premiums if you’re generally healthy and don’t expect to need frequent medical care. Consider a Health Savings Account (HSA) to help save for medical expenses while taking advantage of tax benefits.

Researching health insurance plans thoroughly and comparing coverage and premiums can help you find the best option that meets your healthcare needs and budget.

Understanding Premiums

Health insurance premiums are the amount of money you pay to your insurance provider in exchange for coverage. These premiums are typically paid monthly and are a crucial part of your overall health insurance plan. Understanding how premiums are calculated and the factors that influence them can help you make informed decisions about your healthcare coverage.

Factors Influencing Health Insurance Premiums

Health insurance premiums are determined by a variety of factors, including age, location, coverage level, and health status. Younger individuals generally pay lower premiums compared to older individuals due to the lower likelihood of needing extensive medical care. Additionally, the location where you reside can impact your premiums, as healthcare costs vary by region. The level of coverage you choose, such as a higher deductible plan versus a lower deductible plan, can also affect your premiums.

Relationship Between Deductibles and Premiums

Deductibles and premiums have an inverse relationship in health insurance plans. A deductible is the amount you must pay out of pocket for covered services before your insurance kicks in. Plans with higher deductibles typically have lower premiums, while plans with lower deductibles tend to have higher premiums. This means that you can choose a plan that aligns with your budget and healthcare needs based on how much you are willing to pay upfront versus in monthly premiums.

Healthy Lifestyle and Preventative Care

Maintaining a healthy lifestyle and focusing on preventative care are crucial factors that can help reduce health insurance premiums while also improving overall well-being.

Benefits of Healthy Lifestyle

- Eating a balanced diet rich in fruits, vegetables, and whole grains can help prevent chronic diseases and reduce the need for costly medical interventions.

- Regular exercise not only improves physical health but also reduces the risk of developing conditions that can lead to higher insurance premiums.

- Avoiding smoking and excessive alcohol consumption can significantly lower the likelihood of health issues that may increase insurance costs.

Importance of Preventative Care

- Regular check-ups and screenings can detect health issues early, allowing for timely treatment and preventing costly complications down the line.

- Vaccinations and immunizations help protect against preventable diseases, reducing the need for expensive treatments in the future.

- Managing stress through practices like mindfulness and meditation can improve overall health and lower the risk of developing stress-related conditions.

Examples of Preventative Measures

- Annual physical exams and screenings for conditions such as high blood pressure, cholesterol, and diabetes can help catch problems early.

- Maintaining a healthy weight through diet and exercise can reduce the risk of obesity-related conditions like heart disease and diabetes.

- Participating in workplace wellness programs that promote healthy habits and provide incentives for staying active and eating well can lead to premium savings.

Utilizing Employer-Sponsored Plans: How To Save On Health Insurance Premiums

When it comes to saving on health insurance premiums, enrolling in an employer-sponsored health insurance plan can be a smart choice. These plans are typically offered by employers to their employees as part of their benefits package, and they often come with cost-saving advantages compared to individual plans.

Benefits of Enrolling in an Employer-Sponsored Plan

- Employer contributions: Many employers contribute a portion of the premium costs, reducing the amount employees need to pay out of pocket.

- Group rates: Employer-sponsored plans often come with group rates, which can be more affordable than individual plans.

- Comprehensive coverage: These plans usually provide comprehensive coverage options, including medical, dental, and vision benefits.

- Pre-tax contributions: Some employer-sponsored plans allow employees to contribute to their premiums on a pre-tax basis, providing additional savings.

Maximizing Cost Savings through Employer-Sponsored Plans

- Take advantage of wellness programs: Many employer-sponsored plans offer wellness programs and incentives for healthy behaviors, which can lead to lower premiums.

- Choose in-network providers: Using in-network providers can help reduce out-of-pocket costs and maximize the benefits of the plan.

- Utilize flexible spending accounts (FSAs) or health savings accounts (HSAs): These accounts allow employees to set aside pre-tax dollars for medical expenses, providing additional savings.

- Review plan options annually: Employees should review their plan options annually during open enrollment to ensure they are selecting the most cost-effective plan for their needs.

Options Available for Employees under Employer-Sponsored Health Insurance, How to save on health insurance premiums

- HMOs (Health Maintenance Organizations): These plans require employees to choose a primary care physician and obtain referrals for specialists.

- PPOs (Preferred Provider Organizations): PPO plans offer more flexibility in choosing healthcare providers and do not require referrals for specialists.

- HDHPs (High Deductible Health Plans): HDHPs typically have lower premiums and higher deductibles, often paired with health savings accounts for tax advantages.

- EPOs (Exclusive Provider Organizations): EPO plans offer coverage only for in-network providers, similar to HMOs but without the need for referrals.

Government Subsidies and Tax Credits

Government subsidies and tax credits play a crucial role in helping individuals reduce their health insurance premiums. These financial assistance programs are intended to make healthcare more affordable for those who may not be able to afford full-priced premiums. Understanding what subsidies and tax credits are available, along with the eligibility criteria and application process, can help individuals take advantage of these cost-saving opportunities.

Types of Government Subsidies and Tax Credits

- Advance Premium Tax Credit (APTC): A subsidy provided by the government to help lower monthly premium costs for health insurance purchased through the Health Insurance Marketplace.

- Cost-Sharing Reduction (CSR): Another form of subsidy available to reduce out-of-pocket costs like deductibles, co-payments, and coinsurance for eligible individuals.

Eligibility Criteria

- To qualify for APTC, individuals must meet income requirements and not be eligible for other coverage, such as Medicaid or employer-sponsored insurance.

- CSR eligibility is based on income level and household size, with individuals falling within a certain income range being eligible for reduced cost-sharing.

Applying for Government Assistance Programs

- Individuals can apply for subsidies and tax credits through the Health Insurance Marketplace during the annual open enrollment period or a special enrollment period triggered by qualifying life events.

- When applying, applicants will need to provide information about their household size, income, and current health insurance coverage to determine eligibility for financial assistance.

- It’s important to review and update subsidy applications annually to ensure continued eligibility and potential adjustments based on changes in income or household circumstances.

In conclusion, mastering the art of saving on health insurance premiums is not just about cutting costs—it’s about making smart choices that prioritize your health and financial well-being. By leveraging the tips and strategies Artikeld in this guide, you can navigate the healthcare landscape with confidence and ease.

When it comes to catastrophic health insurance plans, it’s important to understand what is covered. These plans typically provide coverage for major medical expenses after a deductible is met. This may include hospital stays, surgeries, and other high-cost procedures. For more information on what is covered in catastrophic health insurance plans, you can check out this detailed guide.

Comparing health insurance plans online can be a daunting task, but it’s essential to find the right coverage for your needs. By comparing different plans, you can find one that offers the benefits you need at a price you can afford. To learn more about how to compare health insurance plans online effectively, you can visit this informative resource.

For those in need of physical therapy and rehabilitation, it’s crucial to have insurance coverage that includes these services. Physical therapy and rehabilitation can be costly, but with the right insurance plan, you can get the treatment you need without breaking the bank. To explore more about coverage for physical therapy and rehabilitation, you can refer to this comprehensive guide.